We understand that investors have different tolerances for risk, so we offer a bespoke service to help you create a portfolio that fits your investment needs. Our flexible approach and demonstrable track record have given clients the conviction to entrust us with assets exceeding €30 billion in multi-asset portfolios.

First, we need to understand your requirements.

We focus on what you expect from us and consider factors including ease of withdrawal, time, and risk tolerance. Then, our highly experienced team will consider how we can fulfil your needs. They will look at a range of different investment assets, risk exposures, and investment styles to provide a solution that is tailored to you.

We use our own proprietary models to analyse investment opportunities. This bespoke approach sets us apart from our competitors and lets us offer a tailored service that is focused on you.

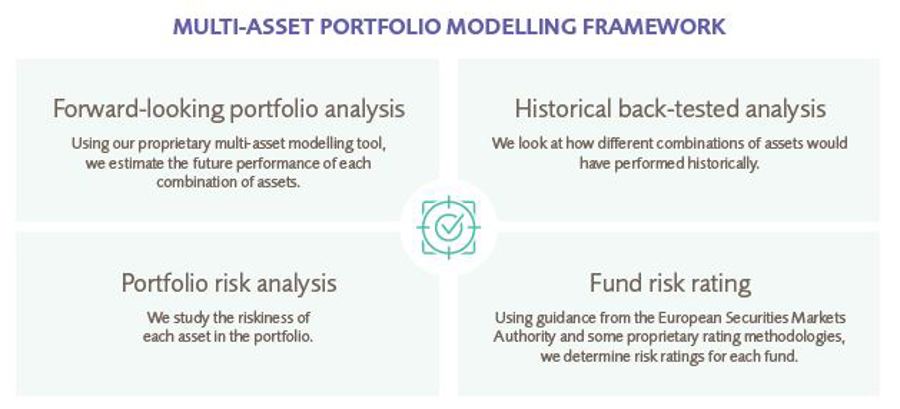

Our portfolio modelling framework features four key elements, each of which aids in designing client portfolios. These features are supported by our proprietary multi-asset modelling tool.

Our Portfolio Solutions team carries out in-depth analysis to identify any factors that might impact the portfolio’s performance and risk level.

We can also help you integrate alternative investment strategies into your portfolio. These could include (but are not limited to) overlay strategies, active strategies, dynamic asset allocation strategies, and life-styling strategies.

Here are some examples of the services we provide:

When designing our portfolio solutions framework, we sought to address a number of key aspects that we felt significantly impacted performance.

These include modelling for extreme events, allowing for the changing volatilities and correlations of asset classes through different economic periods, and allowing for tactical positioning as per client demand.

- Modelling extreme events: Instead of making assumptions about future portfolio performance, we use a method called 'statistical bootstrapping' to model returns. This involves including a random sample of variability in annual portfolio returns to more closely represent real life, and lets us assign a more realistic probability to extreme events that might impact the portfolio. It ensures that the portfolio’s design is more appropriate for its real-life environment.

- Serial correlation of returns: Asset returns tend to exhibit serial correlation. Basically, this means that if the previous month’s returns were positive, it is more likely that the current month’s returns will also be positive. Usually, simulations of portfolio performance assume that asset returns are not related to each other, but this does not really reflect real life. To address this, we allow for the serial correlation of asset returns in our model, and thus ensure that the analysis is more representative of the real world.

- Changing correlations: Over time, differing market conditions change the relationships between assets. Normal simulation models assume that these relationships are constant through time. But, by sampling from history, our model allows these relationships to change as much as they have done in the past.

Key Contacts

Patrick Burke is Chief Executive Officer at Irish Life Investment Managers and a member of the Irish Life Group Executive Team. Patrick has led the growth and evolution of the ILIM business since 2013 reflecting its market leading voice on social and public policy matters for investors. He joined the company in 2006 as Director of Investment Development, responsible for the strategic development of investment solutions for the institutional market. Prior to joining ILIM, Patrick was a director and professional trustee at Irish Pensions Trust Limited, having previously been a corporate lawyer with Mercer. Patrick is past-Chair of Pensions Europe, past Chair of the Irish Association of Pension Funds, and has previously served as Chairman of the Irish Trustee Forum. A solicitor by profession, he is also an Associate of the Irish Taxation Institute and an Associate of the Irish Institute of Pension Managers. Patrick holds a primary degree in Commerce from University College Dublin.

Anthony is Chief Investment Officer (CIO) at Irish Life Investment Managers (ILIM). He leads the firm’s multi-disciplinary investment team with responsibility for the design and ongoing management of ILIM’s range of investment solutions for clients which span Multi Asset solutions, Indexation, Active Fixed Income, Property and Alternatives. His responsibility extends across all aspects of the investment process from research, asset allocation, portfolio construction, trading and also a strategic focus on Responsible Investment.

In recent years, Anthony and his team have been responsible for developing ILIM’s multi asset business and specialised equity strategies including ILIM’s range of ESG solutions.

Prior to taking on the CIO position in January 2022, Anthony held the role of Deputy CIO and Head of Multi-Asset & Quantitative Strategies since 2013. Since joining ILIM in 2004, he has held senior leadership and portfolio management roles with responsibility for fixed income, asset allocation and the development of asset liability management solutions for institutional clients. Prior to joining ILIM, Anthony worked with the Irish National Treasury Management Agency (NTMA) and Pioneer Investment Managers.

Anthony graduated from Trinity College Dublin with an honours degree in Economics and completed the Advanced Management Program with IESE Business School. He also holds both the Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) designations.

Colin joined ILIM in 2017 to build on Irish Life’s de-risking solutions for investors and also joined our executive management team with responsibility for our institutional distribution business.

Colin has unique experience as an investor and former Chairman of Danske Bank DB pension scheme that pursued an aggressive de-risking strategy which culminated in the largest buy-in transaction in Ireland in 2017. He also introduces an alternative view of potential investment opportunities for Irish pension funds and institutional investors to manage their long-term liability profiles.

Prior to joining ILIM, in his role as Treasurer and Head of Danske Bank Markets in Ireland, Colin was a member of both the Executive Board of Danske Bank in Ireland and the Executive of Danske Bank Markets global business. Colin has over 25 years’ management and execution experience in treasury, capital markets, investment management and investment banking transactions. Colin has a MBA from Smurfit Business School, is a Certified Investment Fund Director, Banking Director and completed the Stanford LEAD program. Colin is a fellow of the Institute of Banking in Ireland and a member of the Certified Investment Fund Director Institute.

Gerry is Director of Business & Technology Services in ILIM. He has 25 years’ experience in the IT industry and has worked in financial services for over 20 years. Gerry is responsible for middle & back office operations, IT services, technology, systems development and delivery, and digital channels

Prior to joining ILIM in 1998, Gerry held a number of engineering roles in the financial services, telecoms, and software industries. Gerry has a BSc in Computer Applications from Dublin City University.

Donal Woodcock is Chief Risk Officer. Donal has over 40 years experience in the Irish Life Group and has extensive experience in the financial services industry having worked in finance, risk and compliance managerial roles. Donal is a fellow of the Chartered Association of Certified Accountants (FCCA).

Donal joined ILIM in 2020 and leads our corporate clients team managing our institutional relationships for DB, DC and corporate clients here in Ireland. He is a qualified actuary with over 25 years’ experience.

He works with clients to ensure the asset strategies for their pension arrangements are fit for purpose and aligned with their objectives. This includes all elements of journey plans for DB, including how de-risking interacts with future funding, developing dashboard reporting for Trustees and considering the potential impacts of any settlement options such as buy-ins or buy outs. He also ensures his clients’ wider strategic considerations are being met when they look at their investments which can often now include the role which responsible investing might play. On the DC side he is focussed on working with our clients and partners to develop investment solutions that deliver best outcomes for members and reflect our latest thinking in the area of defaults, drawdown and responsible investing.

Prior to joining ILIM, Donal was a Director in the Pensions Group in PwC where his clients included many of the largest employers in Ireland. He previously worked in Willis Towers Watson as an actuarial consultant where he acted as a Scheme Actuary for many years, delivering the full range of statutory services to Trustee clients.

He is a regular contributor on pension matters both on national radio and at industry events.

As part of ILIM’s investment development team, Brian is responsible for delivering investment strategies and complementary services that meet the objectives of both occupational pension scheme clients and investment consultants.

Brian has over 15 years’ industry experience. He previously worked with Kleinwort Benson Investors and FBD Investment Services, holding a number of key roles focused on both institutional and private clients.

Brian holds a first-class honours primary degree in Business Studies, an MBS in Management Information and Management Accounting from University College Cork, and is a Qualified Financial Advisor (QFA).

Padraic is a member of ILIM’s Distribution team. He is responsible for managing Defined Benefit corporate pension scheme relationships and developing investment solutions for clients, including investment strategy, asset allocation and risk management.

Padraic has 30 years’ experience in pension investment management. Prior to joining ILIM in 2015, he worked for eight years as a senior investment consultant/principal at Mercer, where he provided the full spectrum of investing consulting services to trustees of Defined Benefit and Defined Contribution pension schemes. He also spent 17 years as a senior client portfolio manager with AIB, Ulster Bank and KBC Asset Management. Padraic has been an adjunct third-level lecturer for 14 years, teaching investment management.

Padraic earned a BComm and MBS in Banking and Finance from University College Dublin. He holds the Chartered Financial Analyst (CFA) designation, the Chartered Alternative Investment Analyst (CAIA) designation and the CFA Certificate in ESG Investing and the GARP Sustainability and Climate Risk (SCR) Certificate. He is a Qualified Financial Advisor (QFA), Retirement Planning Advisor (RPA) and Pension Trustee Practitioner (PTP) through LIA Ireland, and is an IIPM Qualified Pension Trustee (QPT).

Elaine is part of the Defined Benefit Client Relationship team in ILIM.

Prior to joining ILIM, she spent 14 years with Danske Bank, initially as money market manager of the then National Irish Bank balance sheet, taking responsibility for the bank’s funding and liquidity requirements whilst managing the bank’s interest rate risk. More recently Elaine developed and managed the Fixed Income & derivative sales desk at Danske, dealing mostly with institutional and large multinational corporate clients. In this role, Elaine gained experience working with Irish pension funds offering risk modelling, LDI and sovereign annuity portfolio construction services. Elaine served as a trustee of Danske Bank Hybrid pension scheme. Previously, Elaine also worked for Pfizer corporate treasury, MeesPierson Investor Services and AIB Security Services. Elane earned a master’s in Real Estate from DIT and also studied the MSc. Investment & Treasury at DCU.

Niall joined ILIM in March 2019 and has over 35 years’ experience in the financial services industry. He was appointed Chief Sustainability Officer in 2023 and is a member of the Executive Management Team. He has overall responsibility for responsible investing in ILIM, including setting strategy, overseeing our stewardship agenda, ensuring adherence to regulatory commitments and working with the investment business to develop new and to enhance existing responsible investment strategies.

Prior to that he was Head of Indexation and Fixed Income, with responsibility for ILIM’s equity indexation business and its active and passive fixed income capabilities. He remains a member of the asset allocation committee.

Prior to joining ILIM, Niall was Global Head of Fixed Income Portfolio Strategy at State Street Global Advisors. He was responsible for leading a team of experienced investment professionals with operations in Dublin, London, Boston, Bangalore and Singapore. The team represented investment capabilities to clients, spanning indexed and active fixed income, LDI, cash and currency. Prior to taking on this role he was Head of Fixed Income and Cash at State Street Global Advisors Ireland (formerly Bank of Ireland Asset Management), as well as managing the institutional real estate investment team. Niall holds a Commerce Degree and a Master’s in Business Studies (first class) from University College Dublin

Euan joined ILIM in October 2023 as Head of Stewardship. This role involves setting the engagement and voting policies and priorities with the help of the stewardship team. We engage with the companies in which we invest clients’ capital to help inspire them to higher standards and better long-term economic outcomes for the benefit of those clients. Prior to that, he had been the Global Head of Stewardship and ESG Investment for Aberdeen Standard Investments and Standard Life Investments before that. Euan moved into sustainability and ESG investing following a 20+ year career as an investment analyst and portfolio manager, initially at Schroders and then at Standard Life Investments. He specialised in analysing banks and insurance companies and also researched aerospace and defence companies for several years. He managed UK equity portfolios for institutional clients totalling more than £4bn.

Euan qualified as a Chartered Accountant in 1989

Lenny was appointed Fund Management Economist in August 2012 and is a member of the asset allocation committee. Previously, he was responsible for managing the financial and retail sectors in ILIM’s active global equity funds. Lenny has over 25 years’ experience in the financial industry.

Prior to joining ILIM in July 2005, Lenny worked for Zurich, AIB and Aviva Investors in equity research and investment management roles.

Lenny graduated with a B.A. in Economics from Trinity College Dublin in 1986, and became an Associate Member of the Institute of Investment Management & Research in 1990.

John joined ILIM in 2011 as a Senior Active Fixed Income Fund Manager and is a member of the Asset Allocation Committee.

John manages discretionary active fixed income strategies for institutional, retail and defined benefit pension scheme clients. John is also responsible for managing ILIM’s LDI product, advising defined benefit pension schemes on their liability matching strategies. He has been at the heart of developing our ALM modelling capabilities. Prior to joining ILIM, John worked as an executive director within the UBS London credit trading department, having previously worked with RBS and JP Morgan.

John is a fellow of the Society of Actuaries in Ireland having qualified while working for Canada Life in Dublin. John graduated from University College Dublin in 2002 with a bachelor’s degree in Actuarial and Financial studies.

Darragh is Head of ILIM’s Multi-Asset Solutions Team. He is responsible for the overall design and management of Irish Life’s MAPS, Ireland’s fastest growing retail multi-asset solution. Darragh and his team are also responsible for helping our clients, across all distribution platforms, design portfolios congruent with their specific objectives and constraints.

Darragh joined ILIM in 2007 as a Quantitative Analyst within the Quantitative Strategies Group and in 2016 was made Head of Portfolio Solutions. Darragh has lectured at UCD Michael Smurfit Graduate Business School on the MSc Finance, MSc Quantitative Finance and MSc Aviation Finance curricula and prior to joining ILIM, worked as a research assistant and lectured various courses at UCD School of Business including Corporate Finance, Econometrics, and Financial Modelling.

Darragh earned a Bachelor of Commerce (BComm) from University College Dublin in 2000, a master’s degree in Quantitative Finance from UCD Michael Smurfit Graduate Business School in 2002, and a master’s degree in Statistics (MSc) from UCD in 2013 and he holds both the Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA) designations.

Peter Haran has been appointed to the position of Head of Multi-Asset Strategies at ILIM. Peter joined ILIM and was appointed to ILIM’s Executive Fund Management group as Head of Alternative Strategies in November 2014. In that role Peter was responsible for the management and development of ILIM’s alternative investment capabilities, including the Multi-Manager Target Return Fund, the Absolute Alpha Fund and the Irish Infrastructure Fund.

Prior to joining ILIM, Peter worked at the National Treasury Management Agency as Head of Investment Strategy for the National Pensions Reserve Fund (NPRF). Prior to his career at the NTMA, Peter was a Portfolio Manager with IIU Asset Strategies for over nine years. During that time, Peter was Fund Manager to the IIU European Long/Short Fund and the IIU Breakout Managed Futures Fund.

Peter holds a bachelor’s degree in Applied Mathematics from Dublin City University and a master’s degree in Computer Applications, also from Dublin City University.

Ronan leads the Research team within the Quantitative Strategies Group, responsible for researching, back-testing and implementing quantitative investment strategies across a variety of asset classes.

Within the equity space, he has led the research agenda which now covers over 100 proprietary factors and developed ILIM’s multi-factor stock selection model. In the area of foreign exchange, he has developed the last two iterations of ILIM’s currency model. Within asset allocation, he has developed the Dynamic Share to Cash model, a core component of ILIM’s multi-asset funds, and more recently a Bond-Cash model for sovereign fixed income strategies. Other research areas include the development and deployment of asset risk models and portfolio optimisation tools.

Prior to joining ILIM, Ronan earned a PhD in Electromagnetic Modelling (TCD), a master’s degree in Theoretical Physics (TCD), and a BSc. in Physics and Applied Mathematics (QUB).

As a member of the Quantitative Research team, Paul is responsible for the ongoing identification and refinement of ILIM’s proprietary factor model inputs and multi-factor modelling approach. Since joining ILIM, he has led several research projects, including ESG factor identification.

Paul has over 10 years of investment experience at leading buy-side institutions. Prior to joining ILIM, he worked for Callisto Asset Management, a systematic equity market neutral fund manager, where he was a Senior Research Analyst and Portfolio Manager responsible for the development and oversight of investment strategies.

He also held a quantitative research position at Fidelity International, where he was involved in the development of global equity strategies and was co-lead on the systematic-based optimised and passive fund mandates, which held a combined AUM of c. $3 billion. Before joining Fidelity, Paul spent four years as a senior member of the Quantitative Equity team at Pioneer Investment Management, where he was responsible for alpha strategy development and portfolio management of the Pioneer European Quant Equity fund ($1billion AUM).

Paul has an MSc in Quantitative Finance from University College Dublin, and a BSc in Financial & Actuarial Mathematics from Dublin City University. He also holds the Investment Management Certificate (IMC) from the CFA Society of the UK

Brian is part of the Indexed Fund Management team in ILIM, responsible for managing a range of equity and fixed income indexed funds. Brian joined ILIM in 1992 and worked for a year in external client reporting, followed by nine years in active fund management as a Portfolio Construction Manager. He then spent over three years as Manager of the ILIM IT Business Analyst team, before returning to fund management and joining the Indexed Investment Team in 2007.

Prior to joining ILIM, Brian worked within the Irish Life group in a number of business and accounting roles in retail, corporate business and central financial accounting.

Brian completed his final Association of Chartered Certified Accountants exams in 1991 and the Institute of Investment Management & Research exams in 1995.

Peter is part of the Indexed Fund Management team in ILIM, responsible for the management of a range of equity and fixed income indexed funds.

Prior to joining ILIM in 2012, Peter worked in the investments industry for 8 years as a private client fund manager and in investment management audit.

Peter graduated from Trinity College Dublin in 2003 with a B.A. Honours Business & Economics degree, qualified as a chartered accountant (ACA) in 2006 and as a Qualified Financial Advisor (QFA) in 2008. Peter received his Chartered Financial Analyst (CFA) designation in 2011.

Michael is part of the Indexed Fund Management team in ILIM, responsible for a range of indexed equity funds.

Prior to joining ILIM in 2006, he worked for six years on the trading desk in Investment Technology Group Europe.

Michael graduated with an honours degree in Commerce from UCC and holds a master’s degree in Economics from UCC. Michael completed the Chartered Financial Analyst (CFA) programme in 2011.

Nicola is part of ILIM’s Indexed Fund Management team, responsible for managing a range of indexed equity funds. She joined ILIM in 1998 and worked for two years as an investment accountant within the finance department, before joining the Indexed Fund Management team in 2000.

Prior to joining ILIM, Nicola worked as an audit manager in practice. Nicola completed her Association of Chartered Certified Accountants exams in 1997.

Alan is responsible for building and managing the groups systematic investment strategies.

Alan has over 20 years of investment experience. Prior to joining ILIM, he worked in the proprietary trading group of Credit Suisse AG, where he was Portfolio Manager responsible for arbitrage strategies. Alan started his career at UBS AG where he completed the graduate training program and worked on the trading floor as an Equity Trader managing a client and proprietary trading book.

Alan has an MSc in Finance from Warwick Business School, and a BSc in Economics & Finance from University College Dublin. Alan holds the Chartered Financial Analyst (CFA) designation.

Eoin is part of the Responsible Investing team in ILIM. Prior to joining the RI team, Eoin worked in the Index Equity team as a fund manager for six years where Eoin managed many of ILIM’s ESG investment mandates. Eoin has been heavily involved in ILIM’s ESG journey since joining. Prior to ILIM Eoin trained in KPMG Dublin as a chartered account for four years. He also worked in Infrastructure and Debt Advisory in AMP Capital Sydney for over four years until August 2015.

Eoin earned a B.Comm with a specialism in finance from University College Dublin in 2006. While in Australia, Eoin received his Chartered Financial Analyst (CFA) designation. Eoin has also undertaken ESG education such as the CFA Institute Certificate in ESG Investing and the CFA Certificate in Climate and Investing, where Eoin was chosen as part of the initial pilot scheme for both. Eoin is also the current President of CFA Society Ireland where he is actively involved and was the founding Chairperson of the society’s ESG Committee.

John is part of the Fixed Income Fund Management team, and is the lead portfolio manager on a range of strategies including corporate bonds and ESG emerging market hard currency.”

John previously worked as a fund manager on the Indexed Equity team. John also worked as an analyst on the Portfolio Construction team, responsible for asset allocation and liquidity management for all portfolios, as well as modelling and generating market orders for active equity funds and overlay strategies.

Before joining ILIM in February 2013, John spent three years as a Performance Analyst in Pioneer Investments.

John earned a Bachelor of Engineering (Mechanical) from NUIG and an MSc in Computational Finance from University of Limerick. John is a CFA Charterholder.

Sean is part of the Indexed Fund Management team in ILIM, responsible for the management of a range of equity indexed funds. Sean joined ILIM in January 2016. Prior to joining ILIM, Sean worked for 7 years in Cantor Fitzgerald, in Risk Management and on the Trading Desk.

Sean graduated from University College Dublin in 2008 with a B.SC. Economics and Finance degree. Sean is a Qualified Financial Advisor (QFA) and received his CFA Charter in 2016

Daire is part of the Indexed Fund Management team in ILIM, responsible for a range of indexed equity funds. Daire previously worked as a Performance Analyst in ILIM responsible for Performance Measurement, Attribution and Appraisal across ILIM’s suite of funds.

Prior to joining ILIM in 2015 Daire worked for State Street for 5 years and Bloomberg for 2 years in fund pricing and market data roles.

Daire graduated from University of Liverpool in 2006 with a B.A. Honours degree in Financial Economics and received his Chartered Financial Analyst (CFA) designation in 2017.

Stephen joined ILIM in 2019 as Head of US & Canadian Partnerships. Stephen has over twenty five years of experience working in global investment management across a range of business management, strategic and client facing roles.

Stephen joined ILIM from ICM Limited, a boutique global investment management business. Prior to this, Stephen was a Director at KKR working as part of KKR's Client & Partner Group in Europe. Stephen also worked at Abbey Capital, a Dublin-based hedge fund that is focused on managed futures and global macro strategies. Stephen also spent 13 years working in the United States where he was a Director of Bank of Ireland Asset Management (U.S.) Limited and head of the business development team for North America.

Stephen has a B.A. in Economics from University College Cork and an MBA from Fordham University, New York. Stephen is an Associate of the Society of Investment professionals (ASIP) and a member of the CFA Institute and has a Certificate and Diploma in Company Direction from the Institute of Directors in Ireland.

Shane joined ILIM in 2006 and works in the Multi-Asset team as the Head of Manager Selection and Derivatives.

He has a BA in Mathematics from TCD as well as Masters degrees in Quantitative Finance (UCD) and Investment & Treasury (DCU). Prior to joining ILIM in 2006, Shane began his career in Naspa Dublin in 2003 where he worked as a credit analyst.

Upon joining ILIM, Shane worked in the Quant Strategies Team for 10 years before moving to the Alternatives Team. He has led this team since 2020, which oversees ILIM’s third-party managed funds and derivatives strategies.

Deirdre is responsible for strategically driving asset management initiatives across the property portfolio enhancing income and capital value through a number of initiatives including leasing, major redevelopment and refurbishment projects.

She is a general practice chartered surveyor with over 24 years’ experience in commercial property Prior to joining Irish Life, Deirdre was Managing Director of Aramark property and a board member of Aramark Northern Europe where she was responsible for the management and development of the business, enhancing service delivery and driving change strategies. Prior to joining Aramark, Deirdre was a founding partner of HT Meagher O Reilly (now Knight Frank).

Deirdre holds a BSc (Surveying) from Trinity College, Dublin and a Diploma in Property Economics from the Dublin Institute of Technology. She is a member of Society of Chartered Surveyor Ireland and the Royal Institution of Chartered Surveyors.

As part of the Investment Development Management team, Aoibheann is responsible for leading the Retail Investment Development Team. The team is responsible for supporting investment sales, product development and operational initiatives across a multi-channel intermediary distribution network.

Prior to joining ILIM in 2018, Aoibheann was Head of Sales & Marketing for Key Capital Investment Management, who specialise in Alternative investments. Aoibheann has held previous roles as Vice President - Senior Business Development & Relationship Management for the State Street Global Advisors, Finance & IT for Bank of Ireland Trust Services, Private Banking and Custody Services.

She holds a Chartered Alternative Investment Analyst (CAIA) designation. She graduated from Dublin City University with a MSc in Investment & Treasury. Aoibheann holds a BA in Economics, Postgraduate in Applied Economics, Postgraduate in Computer Science from University College Cork. She is a member of the Institute of Bankers and a QFA holder.

Cian O’Mahony is an Investment Manager with Irish Life Investment Managers (ILIM) and has over 15 years’ experience in the financial services sector. Having started his career in retail banking, he went on to work in brokerage and derivatives trading before spending the past 7 years in investment management, servicing investors across Europe and the Nordics, focusing on the Irish market upon joining ILIM in 2016.

A graduate of Dublin Business School, Cian holds a Master of Business Studies from the Michael Smurfit Graduate Business School, a Master of Science in Financial Services and Graduate Diploma from UCD. He also has professional qualifications, which include the CERTIFIED FINANCIAL PLANNER™ designation, Qualified Financial Advisor (QFA), Registered Stockbroker (RS) and MSTA from the Society of Technical Analysts.

Jack joined ILIM in 2018 and is a quantitative portfolio manager within the Quantitative Strategies Group.

Prior to joining ILIM, Jack worked for RPMI Railpen in London where he was responsible for strategic asset allocation and investment modelling across a range of multi-asset funds.

Jack holds a BA Economics from Trinity College Dublin and an MSc Finance from Warwick Business School. He is a CFA charterholder.

Duncan joined Irish Life in 2020 and is responsible for the development and management of the Irish Residential Property Fund. IRPF was Ireland’s first open ended residential property fund offering investors access to an institutionally operated vehicle that buys and manages income producing residential property in Ireland.

He is a general practice Chartered Surveyor with over 28 years’ experience in residential and commercial property in Dublin and London. Prior to joining Irish Life, Duncan was the Managing Director and Head of Capital Markets of Lisney, Ireland’s largest independent property agency firm with 140 people across nine offices. Prior to that he worked with CBRE in its City of London office in the UK.

Duncan holds a BSc (Estate Management) from the University of Greenwich, London and a Diploma in Auctioneering, Valuation & Estate Agency from the Dublin Institute of Technology. He is a member of Society of Chartered Surveyors Ireland and the Royal Institution of Chartered Surveyors. He completed the Leading Professional Services Firms executive education course at the Harvard Business School in 2016.

Leonie Mac Cann is Head of Client Investment Solutions, within the Multi Asset Solutions Team. She is responsible for working with clients, across multiple distribution platforms, to help design and manage multi asset portfolios in line with their specific objectives and constraints.

Leonie joined ILIM in 2020 and has over 10 years of investment experience. Prior to joining ILIM, Leonie worked for IBM in their in-house asset management team covering the non-US pension plans. This covered strategic asset allocation, manager selection and portfolio management of a number of pension plans and in-house funds. Before this Leonie worked with Davy in their Private Clients business and spent a number of years as an investment consultant with Willis Towers Watson.

Leonie earned a B.A. Honours degree from Trinity College Dublin in Economics and Philosophy, a Masters in Finance from Bayes Business School, London, and is a CFA charterholder.

Neil joined ILIM as Chief Financial Officer in 2020.

Neil has over 25 years’ experience across financial services and has held a variety of senior finance roles covering asset management, banking and asset servicing. He joined ILIM from Bank of Ireland Group where he was Director of Group Finance. Previous roles within Bank of Ireland included CFO for the Irish Retail Division and Head of Finance for Bank of Ireland Asset Management.

Neil is a fellow of the Institute of Chartered Accountants in Ireland and holds a BSc in Management.

Thais joined ILIM in 2020 as part of the Responsible Investment team. Her role focuses on stewardship activities, supporting the development of the programme and conducting engagement with investee companies on the nature and climate adaptation agendas. Key topics include biodiversity and natural capital, deforestation, water management, and physical climate risks.

Before joining ILIM, Thais spent nearly four years supporting companies in integrating nature and climate considerations into their strategies at a leading Brazilian think tank. During that time, she advised business projects on ecosystem services valuation and climate adaptation planning, designed and delivered training on natural capital management for industry representatives, and produced thought leadership reports for clients, including the Brazilian Federation of Banks, on topics such as carbon pricing and forest finance. Thais also worked as a consultant to the German Agency for International Cooperation, executing projects on corporate water risk and climate resilience.

She holds a Bachelor of Science (Honours) degree in Environmental Management from the University of São Paulo and a Master of Science degree in Climate Change from Maynooth University.

Dara has spent the past 16 years working in the Financial Services Industry. Following 12 years in retail banking, where he advised on financial planning and wealth management from personal investment plans to group pension schemes and everything in between, he then moved to KBC Asset Management where he spent the next 4 years supporting their distribution network in Ireland.

Dara holds degrees in Law and Arts from NUI Galway and is also a Qualified Financial Advisor (QFA). A keen believer in demystifying the world of investments, he has contributed to a number of print articles and podcasts including a series with the Business Post, where he spoke on subjects ranging from Socially Responsible Investing (SRI), to Behavioural Finance. Dara joined the ILIM team as an Investment Manager in 2021 where he supports the distribution of investment products across the Financial Planning and Brokerage channels.

Tim joined ILIM’s Quantitative Strategies Group as a Quantitative Investment Analyst in 2021. He is responsible for supporting fund performance and new strategy development through undertaking quantitative studies and analysis.

Tim has an MSc in Computational Mathematical Finance from the University of Edinburgh and a BSc in Financial Mathematics from University College Dublin.

Paul joined ILIM in 2019 as a Senior Fund Manager and is responsible for the ILIM European Real Estate Fund. This strategy enables investors an opportunity to diversify into Continental Europe, through an institutionally operated vehicle that buys and manages income producing assets across office, logistics, retail, residential and alternative sectors.

He has over 15 years’ experience covering investment management, asset management, fund structuring, real estate private equity, banking and capital markets. Prior to joining ILIM, Paul gained experience in a number of senior roles with Blackstone, as part of the European Real Estate Private Equity team based in London and PwC within the Banking and Capital Markets team in Dublin.

Paul is a fellow of the Institute of Chartered Accountants in Ireland and holds a Bachelor of Commerce from University College Dublin.

Anastasia Joined ILIM in 2022 as part of the Responsible Investment team. Prior to joining ILIM, Anastasia worked at Glass Lewis for seven years providing analysis on Corporate Governance and ESG issues. Anastasia specialised in providing analysis on corporate governance standards and market trends as well as providing consultation on proxy voting policies. Anastasia also worked at Deloitte, in Risk Advisory, where she was involved in projects on board effectiveness reviews and governance policy frameworks.

Anastasia holds a Bachelor’s degree in economics from Democritus University of Thrace, and an M.Sc. in Accounting and Finance from University of Durham.

Mihai is with ILIM since April 2023. During his career he worked in different areas: in Sales, Data Analytics as well as ESG with good experience in leadership roles.

Prior of joining our RI team Mihai was a Senior ESG Analyst for LSEG working on the FTSE Russell Indexes for 4 years. Before that he worked as Master Data Analyst at Accenture for a couple of years.

During his time at London Stock Exchange Group Mihai was an ESG Research Analyst across sectors, specializing in Spain and South America Markets. Mihai also took responsibility of Quality Control of the ESG data gathered working on data stewardship on all the three ESG pillars. He was also involved in interactive guidance updates for the FTSE ESG model as well as handling customer queries.

During his time at Accenture, Mihai’s responsibilities were ensuring data integrity in key systems as well as maintaining the process to support the data quality. Mihai was also involved in providing assistance in resolving data quality problems through the appropriate choice of error detection and correction, process control and improvement, or process design strategies.

Mihai holds a degree in International Business, and a Master’s degree in Management and Marketing of the Organization from Romanian-American University in Bucharest.

Denise joined ILIM in February 2023 and is responsible for managing and developing a strategic partnership within the business. Prior to joining ILIM, Denise was Head of Business Development at Cirera Capital, an emerging markets macro fund based in London and was responsible for asset raising, business development and relationship management. Denise also held previous roles as Institutional Sales at Harmonic Capital, a quant macro fund in London and Investor Relations at Lyxor Asset Management in New York. Denise commenced her career at Societe Generale Securities Services and has over 10 years’ experience in the investment management industry.

Denise graduated from Dublin City University with a Bachelor’s Degree in Business Studies (Finance Specialism). Denise holds the Investment Management Certificate (IMC) and FINRA Series 3 Securities license.

Dee joined ILIM in April 2023 as Strategic HR Business Partner. She has 17 years’ experience as a HR professional, of which 13 years is across Financial Services.

Prior to joining ILIM, Dee was based in London and held the role of Head of HR for J O Hambro Capital Management Limited, an active investment management company. Prior to that, Dee spent 6 years with Chubb Insurance as HR Consultant.

Dee holds a degree in History from UCD, and a PGDip in Business Studies from the UCD Smurfit Business School and a PGDip in Human Resources Management from the London Metropolitan University.

Mariette joined ILIM in 2024 and forms part of the Corporate Clients relationship management team. She is responsible for delivering investment strategies and complementary services to our Institutional clients across the Irish market.

Mariette has 12 years’ industry experience. Prior to joining ILIM she worked as an investment consultant at Mercer where she provided the full spectrum of investment consulting services to trustees of DB and DC pension schemes. Mariette started her career in South Africa and has experience in relationship management in both the retail and institutional markets.

Mariette earned a BComm Honors in Investment Management from the University of Pretoria. She holds the Chartered Financial Analyst (CFA) designation, the CFA Certificate in ESG Investing and is a Qualified Financial Advisor (QFA).

As an Assistant Relationship Manager within ILIM’s Distribution team Philip is central to the delivery of investment services to our DB, DC and Institutional clients across the Irish market. He is also responsible for delivering complementary services to investment consultants and clients.

Philip has a breadth of experience across the financial services sector prior to joining ILIM in 2022 where his clients included some of the largest companies in the International Funds sector and Retail Banking market in Ireland.

He holds a first-class honours at both MSc and Higher Diploma level in FinTech from Dublin Business School. Additionally, he holds a Certificate in Responsible and Sustainable Finance, a QFA Diploma and a Certificate in Consumer Credit all attained through the Institute of Bankers.

Sarah has 20+ years’ experience in financial communications and spent 10 years as Head of Corporate Affairs in Goodbody, with responsibility for marketing, PR and internal communications. Previously, Sarah also held roles in IR and financial communications in Digicel Group and Vodafone Group.

Vincent is a QFA, CFP and holds a grad dip in finance from UCD. He has been in the industry for the past 26 years and have held various senior distribution roles with AIB, Cornmarket, Irish Life and for the past 17 years New Ireland Assurance.

Kevin is an Investment Manager with ILIM who has over 18 years’ experience in the financial services industry. He supports the distribution of investment products across the Brokerage channels. Prior to joining ILIM in 2016, he built up ten years’ experience in the domestic retail insurance industry, working with many of Ireland’s largest brokers, providing financial advice to clients on insurance, pensions, savings and investments.

Kevin holds an honours degree in Public Administration from University of Limerick. Kevin is a Qualified Financial Adviser and Retirement Planning Adviser. He also holds the designation Fellowship of the LIA.

As a Senior Relationship Manager in ILIM, James has responsibility for developing and managing a number of ILIM’s key clients, as well as the development of new client strategies and solutions.

James has almost 12 years of investment experience. Prior to joining ILIM, he was a Director and Senior Consultant in WTW’s Investments business. James worked with delegated/OCIO and advisory clients across teams in Ireland, the UK and Europe. His experience spans investment strategy and journey planning, portfolio construction, liability hedging and structured products, investment manager selection, and governance and implementation/execution advice for institutional investors.

James has an BSc in Actuarial and Financial Studies from University College Dublin. He is Fellow of the Society of Actuaries in Ireland and is Vice-Chairperson of the Society’s Finance and Investment Committee.

Niall joined ILIM's Responsible Investment Team as an ESG Specialist in 2024. Prior to joining ILIM, Niall worked at Bord na Móna on the Corporate Sustainability team. Niall focuses on engagement with investee companies under Social and Governance themes. His other activities involve voting oversight and portfolio screening activities, ESG programme delivery, and investment communications.

Niall holds a M.Sc. Design Thinking for Sustainability from UCD and a B.Sc. in Business and Hospitality from Hotelschool The Hague.

How can we help?

Irish Life Investment Managers (ILIM) is the appointed asset manager to Irish Life Group Limited. ILIM is committed to innovating and leading the market with best in class investment solutions designed to meet the specific investment needs of our clients. Call us at: +353-1-704 1200 or email [email protected].